State and trends in climate adaptation finance 2023

Introduction

Climate change impacts globally have increased the urgency for ambitious action on adaptation. This is especially the case in the world’s most vulnerable regions, including Africa. This report covers global status and trends of adaptation finance and provides a deeper analysis of Africa at a regional level, given the heightened adaptation needs and opportunities on the continent.

Across the globe, and especially in Africa, climate smart and resilient development pathways offer enormous investment opportunities with a triple dividend of avoided losses, positive economic gains, and enhanced social and environmental benefits.

This report assesses the state of adaptation finance globally and in Africa as follows:

- Section 1: Provides the latest analysis on the adaptation funding gap.

- Section 2: Summarizes tracked adaptation finance flows in 2021–2022.

- Section 3: Maps and evaluates institutional adaptation finance commitments and statements.

- Section 4: Assesses the type and efficacy of financial instruments deployed in practice for adaptation.

- Section 5: Reviews the challenges and barriers to tracking adaptation finance.

- Section 6: Presents—for the first time—analysis of the intersection between adaptation finance and humanitarian assistance, including emergency response funding and post-disaster reconstruction funding.

This weADAPT article is an abridged version of the original text, which can be downloaded from the right-hand column. Please access the original text for more detail, research purposes, full references, or to quote text.

Key findings

- Adaptation finance flows declined as a proportion of total climate finance. Via analysis informed by CPI’s Global Landscape of Climate Finance 2023, the report finds that while mitigation finance has accelerated dramatically in the last two years to USD 1.2 trillion annually, adaptation finance saw a more modest increase.

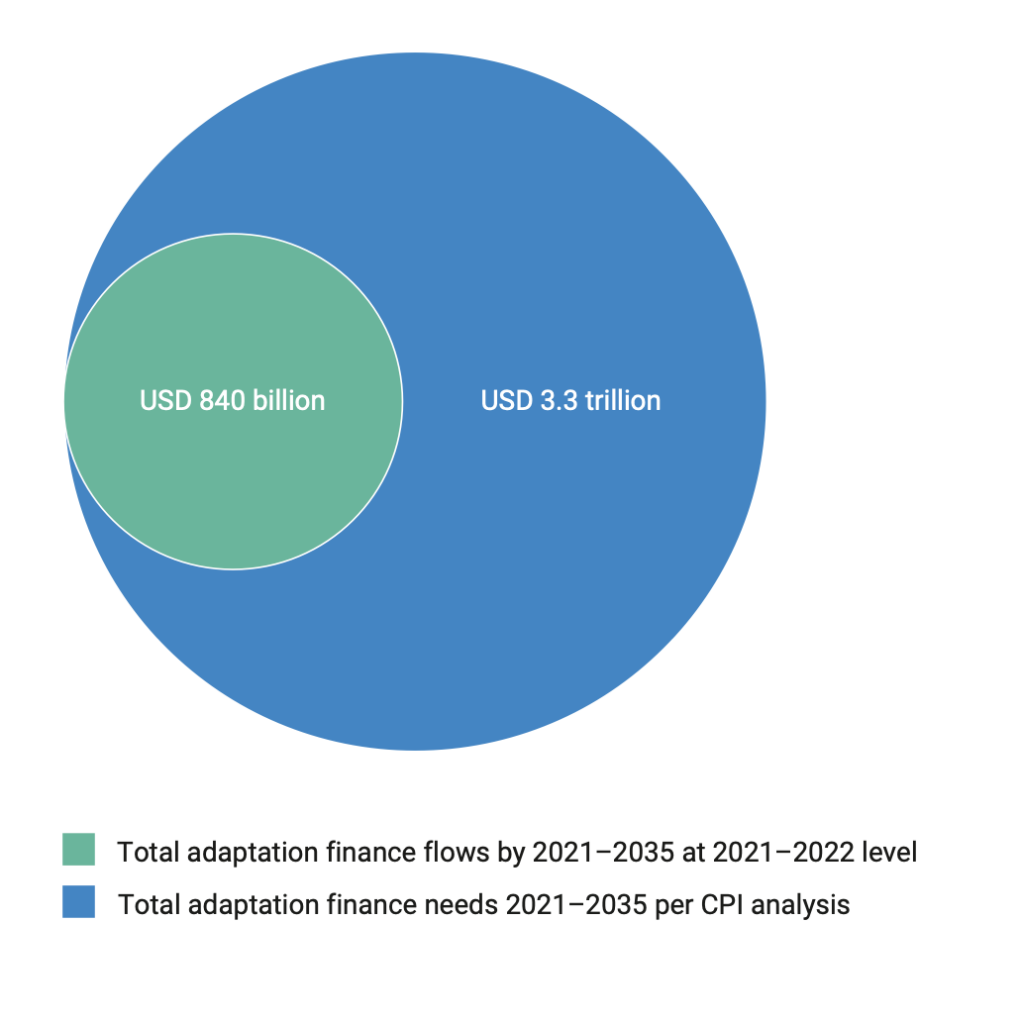

- Adaptation finance needs are rising. The global adaptation funding gap continues to widen concerningly, driven by accelerating climate impacts and relatively slower growth in adaptation finance flows. At the same time, not much is known about the adaptation finance gap. Estimating adaptation finance needs requires robust data, effective modelling, and strong technical capacity. In the absence of these elements, needs assessments are likely to substantially underestimate the true cost of adaptation measures.

Estimated Adaptation Finance Flows and Needs in Developing Countries, 2021–2035

- Institutional public commitments to adaptation finance can create important momentum, but are currently lacking. The report evaluates commitments of 60 public financial institutions and finds that these commitments continue to be insufficient, opaque, and lack clear delivery timelines. By developing institutional adaptation finance commitments that are ambitious, specific, credible, and measurable, public and private institutions can increase momentum towards climate adaptation finance mobilization at scale.

- Climate commitments made to date by the private sector have been almost entirely focused on the low emissions component of the Paris Agreement. Private sector institutional climate commitments towards alignment of private finance flows with a climate-resilient pathway have been limited. Corporations, institutional investors, and commercial banks each must play a role in financing adaptation activities and aligning their commitments with a climate-resilient future, and all three have significant room for growth in articulating commitments to this end.

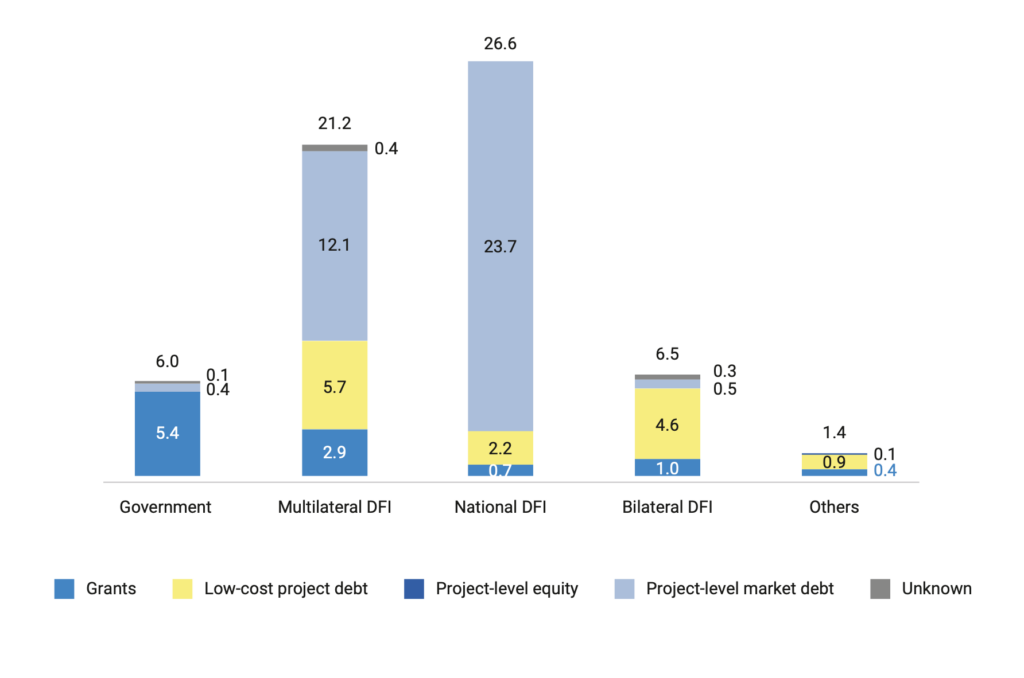

- Debt remains the primary financial instrument for adaptation. To close the gap between current adaptation flows and needs of countries, a wider range of financial approaches are required than are currently being deployed. The report assesses a range of financial instruments and evaluates the potential for debt-for-climate adaptation swaps, which have emerged as an alternative to bridge adaptation finance gaps and tackle debt distress.

- There are emerging opportunities to improve our understanding of the state of play. Adaptation finance tracking is significantly constrained by data gaps, methodological inconsistencies, and reporting issues at both domestic and international levels. There is real opportunity for governments and regulators to strengthen climate finance tracking systems, for development financial institutions to provide more transparency, and for civil society organizations to coordinate and develop simplified adaptation finance tracking methodologies.

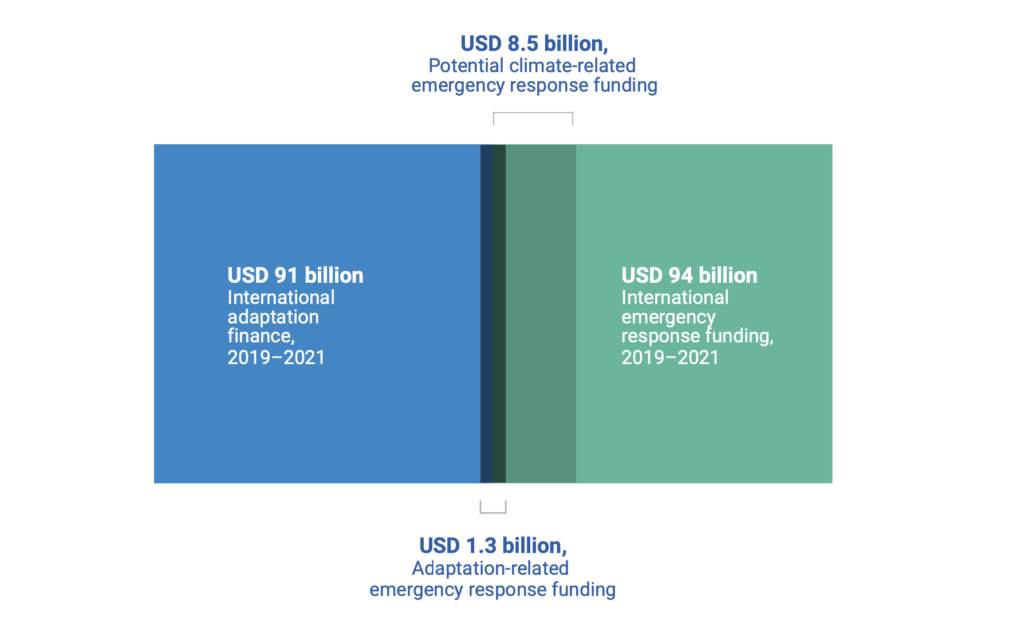

- Adaptation is intertwined with humanitarian aid, and coordinated action on both will be most effective. As incidences of climate-related disasters escalate globally, it is important to increase coordination and collaboration between actors working on humanitarian aid and climate change adaptation. The analysis emphasizes the opportunities for actors to spearhead ex-ante, proactive adaptation action to avoid or minimize spending on humanitarian aid later.

Interlinkages between Tracked Funding Buckets, 2019–2021

(0) Comments

There is no content