Assessment of innovative climate financing instruments for adaptation action in India

Introduction

In comparison to mitigation activities, adaptation so far has lagged in terms of private sector financing. In India, most of the funds for adaptation are being disbursed from budgetary sources. In addition, the government has resorted to fiscal instruments like subsidies and taxes, tax free bonds and specification related to devolution of funds under 14th Finance Commission that incentivises afforestation. Current adaptation activities are also being funded domestically through the National Adaptation Fund for Climate Change (NAFCC) and internationally through funds like Adaptation Fund, Green Climate Fund, Global Environment Facility etc. in form of grants. However, there is a significant financing gap that arguably can be financed through the involvement of private sector.

Innovative financing mechanisms and exploring other sources of finance for climate change adaptation interventions is required to complement public sector efforts and the existing interventions by the multilateral/bilateral agencies. The following article presents an assessment of innovative climate financing instruments for adaptation action, giving the potential for scaling up adaptation activities in India with the involvement of private sector.

*Download the full publication from the right hand column. The key messages from the publication are provided below. See the full text for much more

Methods and Tools

The study involved significant desk research along with stakeholder consultations with the private sector (large organisations, private sector banks, non-profits etc.) to understand the potential for scaling up adaptation activities in India. The figure below represents the overall approach and methodology adopted for developing the report:

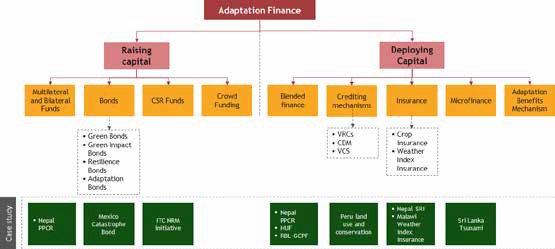

Overview of Financing Instruments

Intangibility inherited in adaptation projects makes it difficult to assess the value gained from engaging in an activity or evaluating the benefits, thus making it difficult to determine a business case. As a result, there is a lack of consensus regarding the extent to which different financial instruments should be considered as contributing to scaling-up international climate finance. Based on the experiences across the globe regarding adaptation finance, the following figure gives an overview of various instruments categorised under broader themes.

Based on the literature review, the table below briefly describes the various instruments which are either used to finance adaptation activities or those which have the potential to be expanded from mitigation to adaptation, along with the limitations of each instrument.

Features of Financial Instruments

|

Finance mechanism |

Main features and limitations |

Applicability |

|

Raising capital |

||

|

Multilateral and bilateral funds |

Provides incentive for private financing by financing actions with lowest return |

Widely used in India for adaptation (e.g. National Adaptation Fund for Climate Change projects) |

|

Bonds |

||

|

Green Bonds |

Available only for large-scale investments targeting energy-efficiency, renewable energy projects etc. |

Widely used for mitigation only (e.g. renewable energy, green buildings), including possibly adaptation/resilience (e.g. Belgium Green Bond) |

|

Impact Bonds |

Outcome based finance mechanism, requires evidence-base that the initiative works, relatively new mechanism used in the social space |

Yes, used in India and other developed countries such as Australia in social impact investing but not for adaptation |

|

Resilience Bonds |

Linked to catastrophe (CAT) bonds, but ‘proceeds’ used for resilience |

Not used in India yet, but piloted in Mexico |

|

Adaptation Bonds |

Challenges related to revenue streams |

Climate Bonds Initiative developing a Water Standards, Great Barrier Reef Foundation piloting a Great Barrier Reef Bond. |

|

Corporate Social Responsibility (CSR) Funds |

Internal Corporate Social Responsibility fund designated based on profits but typically directed towards infrastructure development and mitigation |

Used in India by few corporates (e.g. ITC limited) |

|

Crowd Funding |

Funding/financing by collecting small scale funds via Internet platform |

Not used extensively for climate change |

|

Deploying Capital |

||

|

Blended finance |

Most used mechanism for deploying funds from multilateral and bilateral organisations through public private partnerships |

Used in developing countries (e.g. Nepal) |

|

Crediting mechanisms |

Cross-cutting agri-based activities resulting in payments through results-based payments and vulnerability reductions |

Typically used for Agro-Forestry (e.g. REDD+ projects) and cross-cutting (mitigation and adaptation) projects such as improved cook stoves, micro-irrigation |

|

Insurance |

Risk based financing typically used for post-disaster funding |

Used in developing countries for crop protection and public-property rehabilitation (e.g. Malawi, Nepal System of Rice Intensification) |

|

Microfinance |

Small scale financing provided to those who cannot access mainstream financing from banks and Government |

Used in developing countries for rehabilitation (e.g. Sri Lanka Tsunami rehabilitation) |

|

Adaptation Benefits Mechanism |

A non-market based mechanism which certifies social, economic and environmental benefits of adaptation activities. De-risks and incentivises investments by facilitating payments for delivery of adaptation benefits. |

Developed by the African Development Bank, it is being piloted in Africa. |

Lessons Learnt

It is evident that the Government is primarily responsible for implementing climate change adaptation in India and there seems to be lack of funds which hampers the implementation of adaptation activities on a larger scale. Lack of financial resources including lack of credit facilities, loans and subsidies appear to be key barriers for enhancing adaptation finance. However, since adaptation activities place significant pressure on Governments to infuse additional budgets, involving the private sector appears to be a viable and necessary solution for the long-term. From the private sector perspective, adaptation (including finance) is not a mainstream portfolio in India, although there seems to be a recognition on the need to work not only on mitigation but also on cross-cutting initiatives with adaptation benefits. The need for adaptation finance is also affirmative among the private sector despite this not being considered as a distinct method of financing and continues to be conceptual in nature.

Having said this, the study has aided in establishing the potential drivers for scalability of adaptation projects by private sector which are summarised as follows:

- Climate risks are considered as a critical enterprise risk which needs to be addressed with immediate action

- Strengthening of supply chains through de-risking measures is essential, since organisations have a sizeable share in local economies and are likely to have a significant impact on overall resilience and adaptive capacities of the society

- Public private partnerships or multi-sectoral, multi-stakeholder partnerships are receiving increasing attention as key instruments for tackling climate change concerns as they harness the strengths of private, public, and non-profit partners

- Leveraging the knowledge of Governments and communities on local scenarios can enable the private sector to develop more robust adaptation strategies which can build adaptive capacities of the communities and ensure that their adaptation activities reduce the climate change vulnerabilities faced by these communities

Suggested citation

Ghosh, D., Kanda, K., Sengupta, P., Varsha, D., Awasthi, K., Bhatt, S. and J. K. Gaurav(2019). Assessment of Innovative Climate Financing Instruments for Adaptation Action. Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH.

Further readings

Mainstreaming Gender in Climate Change in India

The Role of Domestic Budgets in Financing Climate Change Adaptation

Related resources

- Guidebook: Mobilising private sector finance for climate change adaptation

- The Roles of the Private Sector in Climate Change Adaptation - an Introduction

- Engaging the private sector in financing adaptation to climate change: Learning from practice

- Engaging the Private Sector in National Adaptation Planning Processes

- A framework for mobilizing private finance and tracking the delivery of adaptation benefits

- Understanding and increasing finance for climate adaptation in developing countries

- Accelerating Adaptation in India with State Action Plans on Climate Change

- Planning and Implementation of Climate Change Adaptation in Rural Areas of India

(0) Comments

There is no content