Microinsurance

Introduction

Microinsurance, like traditional insurance, is a risk-sharing mechanism in which premiums are paid by all members of the insurance scheme, and this pool of premiums is used to reimburse those members of the scheme who suffer losses from a pre-defined set of perils [1]. The difference between microinsurance and traditional insurance, however, is that microinsurance specifically sets out to provide affordable and accessible insurance to low-income people who cannot gain access to traditional forms of insurance [2]. As such, the ‘goal of microinsurance is to make appropriate, affordable risk-management tools available to the poor to help support their economic development’ [3] by providing a precautionary (ex ante) mechanism for coping with losses.

The Need for Microinsurance

Insurance coverage in developing countries is low, with only 3 % of losses caused by disasters in developing countries are covered by insurance. Even allowing for influxes of donor aid an average of 90% of the costs reconstruction are borne by the governments of affected countries [4], which can severely impact economic growth, for example after Hurricane Mitch struck the island of Honduras the government faced reconstruction bills of $1250/capita, and 5 years after the event GDP was 6% below pre-Mitch estimations of growth [5]. Increasing insurance coverage is seen as a way of transferring the risk from disasters away from vulnerable countries and populations to the global insurance market, and additionally provides a more dignified way of coping with losses than reliance on foreign aid [6].

Vulnerable communities are not helpless in the face of disasters, and a variety of informal coping mechanisms are employed to help reduce the impact of disasters or shocks and minimize the disruption to livelihoods that these events cause. These strategies vary, but common mechanisms include diversifying assets, strengthening personal and communal networks which can be relied upon in a crisis, reciprocal borrowing schemes, ‘self-insurance’ (accessing microcredit or savings to deal with losses) and the sale of assets to raise capital [7][8]. In some areas informal insurance groups also exist, generally organized through existing community groups or networks, for example funeral groups in Uganda [9]. These coping mechanisms are useful for dealing with small and individual risks but can be overwhelmed by large losses, in particular if these are covariate and affect all members of the community at the same time [10]. By transferring risk formal microinsurance can decrease the vulnerability of communities and individuals to disasters and aid in coping with large and covariate events. Microinsurance schemes are varied, but can be divided into 2 broad categories; conventional or indemnity microinsurance schemes, and index-based schemes.

Conventional Schemes

Conventional, or indemnity based microinsurance, works in the same way as traditional insurance, with a premium paid to the insurer to protect against losses from a certain set of perils, and claims then filed if losses occur due to those pre-defined perils. The insurer must then assess the damage which has occurred and decide on how much is due to be paid out to the client. In order for these schemes to be sustainable, the amount collected in premiums must be more than the total of the amount paid out in claims and the administrative costs. One of the major problems with microinsurance, therefore, is how to keep the premiums affordable to the low-income groups which are the target of the product, yet at the same time ensuring sustainability of the schemes.

There are many issues which need to be resolved in order for conventional microinsurance schemes to function correctly. The problem of ‘moral hazard’ is a major issue with all conventional schemes; the idea that because people are insured they do not adapt their behaviour to reduce risk as they would do otherwise, and so are more are in a more vulnerable position because of insurance [11][12]. This is widely acknowledged as a problem, however, and conventional policies can be designed so that they reward risk-reducing activities, for example by including deductibles in the premiums [13].

If offered on a voluntary basis, conventional schemes are also susceptible to the problem of adverse selection, where only the most at risk members of a community will subscribe to the insurance policy, creating a high level of claims which then drives the price of premiums out of the reach of the target clientele of microinsurance [14][15]. Transaction costs and overheads are inherently higher in conventional policies due to the need to assess losses before paying claims, which can lead to issues relating to keeping premiums affordable, as well delaying the process of paying out for claims.

Examples of conventional microinsurance schemes

Index Insurance Schemes

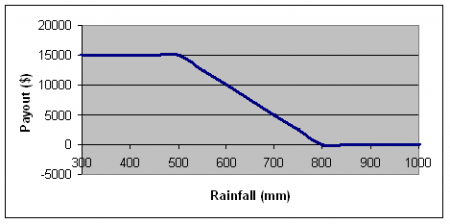

Index based insurance works in a fundamentally different way to conventional insurance. Premiums are still paid in the same way but rather than payments being based on an assessment of the losses which occur due to a specific event, as with conventional insurance, they are linked instead to an ‘index’. This index can be many different things, but might commonly be weather related, for example a rain-based index, and should be strongly correlated to losses which occur as a result of variation in this index [16]. Thresholds are identified in this index at which significant losses are expected to occur, and the insurance scheme will payout progressively larger amounts as the conditions in the index move further from the average. Typically there will be a maximum limit to payouts to protect insurers against very large payouts related to the most extreme events. The expected value of the crop can be calculated, as can the losses in yield if rainfall reaches the limit value on the index, and thus a monetary value can be assigned to each mm of rainfall below the trigger [17]. For example, if the total value of a crop is $25,000 if rainfall is 800mm or above, and the value of the crop at the limiting point of 500mm is $10,000, then it can be calculated that each mm below 800mm is worth $50 ($15,000/300), see Fig 1.

Fig. 1. Hypothetical sliding scale of insurance payouts. After [18]

Index schemes do not suffer from the issue of moral hazard, as there is no link between the behaviour of the policy-holder and pay-out; pay-out is not based on losses but on an independent index, so the policy-holder still has every incentive to reduce losses to their crop by reducing their risk [19][20]. Equally there is no problem of adverse selection, because the pay-out is linked to the index and not to the degree of exposure of the client, for example pay-out will be the same for a policy-holder a high risk as for one at low risk.

Index insurance has lower administration costs than conventional insurance because pay-outs are very easy to verify and there is no need for any losses to be verified in the field [21][22], thus allowing for lower premiums to be offered. In addition, index insurance policies can be sold in standard amounts, for example $10 or $100, as there is no need to tailor the policies specifically to individual circumstances. This makes them easy to distribute, for example through retailers, and also creates a secondary market in which the policies can be traded [23].

The key to ensuring that index insurance works is that there must be a strong correlation between the index and losses experienced, in order to minimize the problem of ‘basis risk’. This occurs when the correlation between the index and losses breaks down, and either losses occur but the trigger has not been reached on the index so no pay-out occurs, or vice versa [24]. This is problematic because it requires at least 30 years of reliable historical data relating to the index (Corbett), which in many cases may not be available, as well as the fact in many areas it is increasingly likely that in a changing climate historical meteorological data may not be a good indicator of future conditions, adding another layer of complexity to the determination of premiums [25]. Problems are also encountered where there are regional weather oscillations, such as ENSO or the NAO, which cause conditions to significantly depart from the average [26].

Index insurance schemes must also ensure that the measurement of the index, for example the local weather station, is representative of the area covered by the scheme, so a climatically homogenous area is advantageous. In practice, therefore, weather index insurance is not applicable to crops which grow in defined microclimates, such as coffee [27]). The means of measurement must also be tamper-proof, otherwise the potential to alter measurements and defraud the system is too great [28][29].

Examples of Index-based microinsurance schemes

| Conventional Insurance | Index Insurance | |

|

Advantages |

· Applicable to a wider range of situations than index insurance, as it covers all risks where losses are involved.

· Actuarial procedures for conventional schemes are well established and thus schemes should be easy to run · As claims are paid by assessing losses directly, there is no issue of basis risk. |

· No problem of moral hazard as the behaviour of the client does not influence the pay-out.

· No problem of adverse selection as pay-out is independent of losses. · No need to assess claims so lower transaction/overhead costs. · Pay-outs can be rapid because claims are verified easily through the index rather than assessment of losses. · Policies can be sold as standard packages. |

|

Disadvantages |

· Moral hazard is an issue unless there are deductions built into the premium for risk reduction.

· Adverse selection can occur with voluntary schemes, in particular if there is asymmetric information and the client knows more about their risk than the insurer. · Transaction costs and overheads are high because of the need to assess losses. · The claims assessing process can be time-consuming, leading to slower pay-outs. |

· Basis risk, where correlation between payouts and losses breaks down and payment occurs without losses, or vice versa.

· Historical data needed to create the index, but this may not be an accurate predictor of future conditions · Needs a relatively homogenous area to ensure that losses correlate to the index. |

Related Pages

- Nepal baseline vulnerability assessment and social indices

- Decision Making Explorer

- Scaling up microinsurance

External Links

References

- 1 Mechler, R., Linnerooth-Bayer, J. and Peppiat, D. (2006) Microinsurance for Natural Disaster Risks in Developing countries: Benefits, limitations and viability. ProVention Consortium.

- 2 Churchill, C. (ed.) 2006 Protecting the poor: A microinsurance compendium. Geneva: ILO in association with MunichRe

- Botero, F. et al. (2006) The Future of Microinsurance, p584 In Churchill, C. (ed.) 2006 Protecting the poor: A microinsurance compendium. Geneva: ILO in association with MunichRe.

- ↑ Hoeppe, P. and Gurenko, E.N. (2006) Scientific and economic rationales for innovative climate insurance solutions. Climate Policy 6: 600-607

- ↑ ProVention (2005) The potential benefits and limitations of microinsurance as a risk-transfer mechanism for developing countries. ProVention Consortium.

- ↑ ProVention (2005) The potential benefits and limitations of microinsurance as a risk-transfer mechanism for developing countries. ProVention Consortium.

- ↑ DFID (2004) Adaptation to Climate Change: Can Insurance reduce the Vulnerability of the Poor? DFID Key Sheet 8.

- ↑ Sebageni, G. (2002) Assessing the need for Microinsurance in Uganda. MicroSave-Africa: An initiative of Austria/CGAP/DFID/UNDP.

- ↑ Sebageni, G. (2002) Assessing the need for Microinsurance in Uganda. MicroSave-Africa: An initiative of Austria/CGAP/DFID/UNDP.

- ↑ Skees, J., Hazell, P. and Miranda, M. (1999) New approaches to Crop Yield insurance in developing countries. EPTD Discussion Paper No. 55

- ↑ Churchill, C. (ed.) 2006 Protecting the poor: A microinsurance compendium. Geneva: ILO in association with MunichRe

- ↑ ProVention (2005) The potential benefits and limitations of microinsurance as a risk-transfer mechanism for developing countries. ProVention Consortium.

- ↑ Mechler, R., Linnerooth-Bayer, J. and Peppiat, D. (2006) Microinsurance for Natural Disaster Risks in Developing countries: Benefits, limitations and viability. ProVention Consortium.

- ↑ Skees, J.R. (2004) Innovation in Agricultural Insurance: Linkages to Microfinance. USAID Documento de trabajo No. 3

- ↑ Mechler, R., Linnerooth-Bayer, J. and Peppiat, D. (2006) Microinsurance for Natural Disaster Risks in Developing countries: Benefits, limitations and viability. ProVention Consortium.

- ↑ Skees, J., Hazell, P. and Miranda, M. (1999) New approaches to Crop Yield insurance in developing countries. EPTD Discussion Paper No. 55

- ↑ World Bank (2005) Managing Agricultural Production Risk: Innovations in developing countries. World Bank Agriculture and Rural Development Department, Report No 32727-GLB.

- ↑ World Bank (2005) Managing Agricultural Production Risk: Innovations in developing countries. World Bank Agriculture and Rural Development Department, Report No 32727-GLB.

- ↑ Skees, J.R. (2004) Innovation in Agricultural Insurance: Linkages to Microfinance. USAID Documento de trabajo No. 3

- ↑ Corbett, J.D. (2005) Making Climate-related insurance work in Africa: targeting and monitoring micro-insurance programmes.

- ↑ DFID (2004) Adaptation to Climate Change: Can Insurance reduce the Vulnerability of the Poor? DFID Key Sheet 8.

- ↑ Leftley, R. and Mapfumo, S. Effective Micro-insurance programmes to reduce vulnerability. Opportunity International Network.

- ↑ Morduch, J. (2004) Micro-insurance: The next revolution? In Bannerjee, A. et al (eds.) What have we learned about Poverty? Oxford: OUP.

- ↑ Mechler, R., Linnerooth-Bayer, J. and Peppiat, D. (2006) Microinsurance for Natural Disaster Risks in Developing countries: Benefits, limitations and viability. ProVention Consortium.

- ↑ Morduch, J. (2004) Micro-insurance: The next revolution? In Bannerjee, A. et al (eds.) What have we learned about Poverty? Oxford: OUP.

- ↑ World Bank (2005) Managing Agricultural Production Risk: Innovations in developing countries. World Bank Agriculture and Rural Development Department, Report No 32727-GLB.

- ↑ World Bank (2005) Managing Agricultural Production Risk: Innovations in developing countries. World Bank Agriculture and Rural Development Department, Report No 32727-GLB.

- ↑ Skees, J.R. (2004) Innovation in Agricultural Insurance: Linkages to Microfinance. USAID Documento de trabajo No. 3

- ↑ Mechler, R., Linnerooth-Bayer, J. and Peppiat, D. (2006) Microinsurance for Natural Disaster Risks in Developing countries: Benefits, limitations and viability. ProVention Consortium.

(0) Comments

There is no content