A framework for mobilizing private finance and tracking the delivery of adaptation benefits

Introduction

Over the last decade, there has been the growing expectation from the international community that the private sector will become an important source of finance for climate change adaptation in developing countries. However, this potential still remains unclear. While it is expected that some private actors will purposefully or unconsciously invest in reducing their own vulnerability, it is far less obvious how the public sector can mobilize private investments in adaptation that deliver benefits to the broader community.

So how can countries understand and increase private sector contributions to the financing of adaptation activities? In order to address this question, this paper* develops an empirically driven, conceptual framework for private adaptation finance and tests it in two countries in Sub-Saharan Africa: Kenya and Rwanda.

*Download the paper from the right-hand column. The sections before provide a summary of the key information from the paper (see the full text for more detail).

The Framework

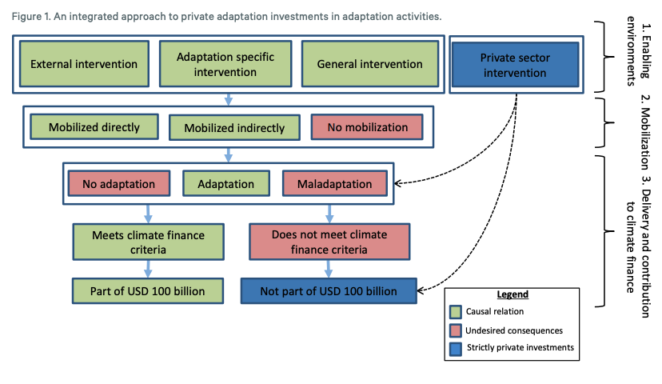

The purpose of the framework is to help users identify enabling environments in the context of a given country. The framework also helps identify interventions that are both successful and unsuccessful in mobilizing private investment, as well as examines to what extent these interventions are delivering (or not delivering) adaptation benefits.

There are three steps in this framework:

- Step 1: Identifying enabling environments

- Step 2: Mobilization

- Step 3: Delivery of adaptation benefits

For more detail on this framework download the full report from the right-hand column.

Private Adaptation Finance in Kenya and Rwanda

- Enabling Environments

The application of the framework demonstrates that both Kenya and Rwanda have developed a broad institutional and regulatory framework for adaptation over the past few years, including the explicit intent to mobilize private finance for climate activities. Donors and international organizations are supportive of the intent but have limited experience themselves. In both countries, there is widespread recognition that the creation of an enabling environment is difficult and that barriers for the mobilization of private investments in adaptation still exist. In contrast, private sector interventions – where one private actor stimulates another to adapt – are so far rare.

- Mobilization

Enabling environments created by the public sector are expected to mobilize additional private investments that could contribute to adaptation (see Figure 1). After applying the framework in Kenya and Rwanda, enabling environment instruments seem to have a limited effect on both direct and indirect mobilization of investments in adaptation.

- Delivery of finance for adaptation benefits

Mobilized adaptation investments don’t necessarily lead to adaptation. Furthermore, a lack of knowledge and experience with adaptation, or a narrow focus on self-interest, may lead the private sector to invest in counterproductive measures, known as maladaptation. Using the framework in Kenya and Rwanda resulted in only anecdotal evidence of private investments that created adaptation benefits or caused maladaptation. It is therefore uncertain to what extent enabling environments and mobilized investment have contributed to adaptation.

Strengths and Weaknesses

Strengths and weaknesses in current practices for mobilising private finance for adaptation in Kenya and Rwanda:

The framework demonstrates that both Kenya and Rwanda have a strong focus on public policy and regulatory instruments to mobilize private investments, both for adaptation and for more general purposes.

Beyond the role of national governments, international actors operating in Kenya and Rwanda – including bilateral agencies, international organizations and multilateral development banks – generally support the concept of private finance mobilization, but have limited experience themselves with mobilizing private finance for adaptation

Economic instruments have not been widely used, but there is a recognition that more of these instruments are required and that the financial sector needs to be more actively involved. Currently, the financial sector in both countries is investing an increasing amount in mitigation activities, such as clean cookstoves and solar energy, but not in adaptation-related products.

Based on this research, we recommend incorporating adaptation components into environmental impact assessments (EIAs), to ensure the monitoring and reporting of private contributions that have an indirect effect on adaptation. Doing so would help to prevent maladaptation, while maximizing the positive contributions to adaptation.

Conclusion

While an enabling environment is an important first step for mobilization of private finance, as often argued in literature, it is also crucial to enforce existing policies and consistently install and apply safeguard mechanisms, as well as to create awareness of climate impacts among private sector actors. Otherwise, the high expectations around the private sector’s financing of adaptation will not be met, which would leave communities, businesses and countries vulnerable to climate change.

The framework has three big advantages:

- By structuring complex discussions around the mobilization of private investments in effective adaptation, it helps to identify countries’ strengths and weaknesses.

- The framework can stimulate a debate on how enabling environments can be unsuccessful, how mobilization of investments might fail, and of how private investments can cause maladaptation. These issues are so far hardly addressed in literature and policy debates.

- The framework can help to shift the focus from stimulating action (through an enabling environment) towards stimulating successful adaptation (through monitoring and reporting, and enforcement in general). Enabling environments are only a means to an end, and not an end in itself.

Suggested Citation

Dzebo, A. and Pauw, P. (2019), A framework for mobilizing private finance and tracking the delivery of adaptation benefits. SEI Working Paper. Stockholm Environment Institute, Stockholm.

(0) Comments

There is no content